In this special guest feature, Peter ffoulkes from OrionX outlines a series of new reports that show how InfiniBand continues to dominate the market for High Performance Interconnects.

Peter ffoulkes, OrionX

The OrionX Constellation reports published June 29th address the evolution, environment, evaluation and excellence ratings for the High Performance Interconnect (HPI) market. Defined as the very high end of the networking equipment market where high bandwidth and low latency are non-negotiable, HPI technologies support the most demanding workloads that are typical of extreme-scale systems in high performance computing (HPC), artificial intelligence, cloud computing, and web-scale deployments.

High Performance Interconnect Technologies

The HPI technology and vendor environment is currently in a state of significant transition. The primary market categories include proprietary technologies and two standards based technologies, Ethernet and InfiniBand.

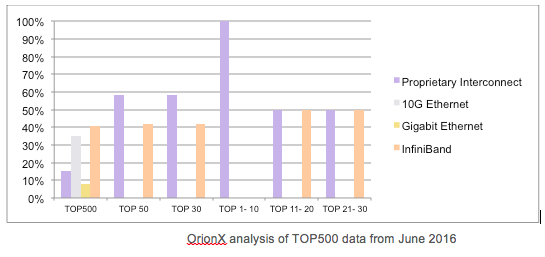

Although not representative of the entire HPI market, the TOP500 list that ranks the world’s most powerful publicly disclosed HPC systems is a reasonable proxy for the dynamics of the HPI market. In the most recent list Ethernet accounted for 44% of the TOP500, InfiniBand 41%, and proprietary interconnects 15%. While Ethernet leads by volume in the TOP500, it is worth noting that only five of the TOP100 systems are Ethernet-based, leaving the most powerful systems to proprietary and InfiniBand interconnects. Proprietary interconnects account for the entire TOP10, while the TOP11-30 are divided equally between proprietary interconnects and standards-based InfiniBand products.

High Performance Interconnect Vendors

High Performance Interconnect Vendors

While Ethernet is a ubiquitous technology supported by a plethora of vendors it does not represent the high ground of the HPI market which is the domain of InfiniBand and proprietary technologies.

By their very nature proprietary interconnects are distinct and come from a number of vendors, but that is a relatively small number, and growing rapidly smaller. The technologies and engineering teams that accounted for over half of the proprietary interconnects on the TOP500 have been acquired by Intel, as were the InfiniBand assets of QLogic, which positions Intel to be a significant HPI vendor going forwards. For now Omni-Path accounts for just eight systems on the TOP500, with just one in the TOP100. However we can expect this to increase as new HPC systems are deployed and Intel moves from the first generation Omni-Path implementations which already deliver competitive performance to future generations.

InfiniBand is the standards-based approach to the HPI market, governed by the InfiniBand Trade Association (IBTA) in conjunction with the Open Fabrics Alliance (OFA). The IBTA focuses primarily on the hardware and standards aspects of InfiniBand while the OFA focuses primarily on a unified, cross-platform, transport-independent software stack. Both Intel and Mellanox are significant contributors to both the IBTA and OFA.

The OrionX HPI Rankings

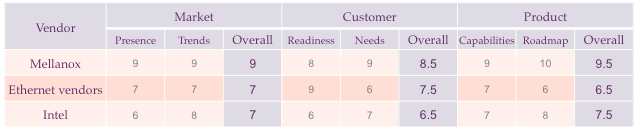

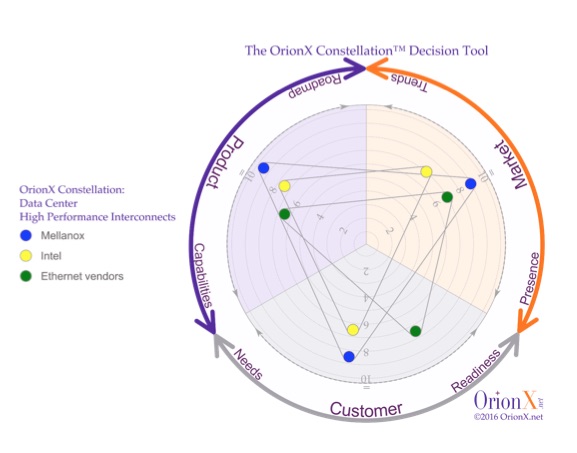

The OrionX Constellation methodology assesses the market in six dimensions organized into three major categories:

- Market presence and trends: a vendor’s presence in the segment and its ability to shape or embrace market trends

- Customer needs and readiness: a typical customer’s current needs and readiness to adopt a particular product

- Product capabilities and roadmap: a product’s existing capabilities and competitive standing as well as its expected enhancements and replacements in the future.

These six parameters are designed to capture the essentials of technology customers’ selection process.

The table and OrionX Constellation Decision Tool diagram below summarize our assessment and perspective on major HPI vendor choices. Ethernet vendors have been combined into a single virtual vendor.

At the high-end of the HPI market, InfiniBand and Mellanox have the dominant position for now while Intel is the young pretender to the throne. From both a technology and proven performance perspective InfiniBand appears to be the safe bet, but the HPC arena is where big bets are made and sometimes lost.

For now, InfiniBand and its vendor community, notably Mellanox appear to have the upper hand from a performance and market presence perspective, but with Intel entering the HPI market, and new server architectures based on ARM and Power making a new claim on high performance servers, it is clear that a new industry phase is beginning. A healthy war chest combined with a well-executed strategy can certainly influence a successful outcome.

All four OrionX Constellation reports are available here.