Today Hyperion Research released its updated analysis of the potential impact areas of the covid-19 pandemic on the HPC market based on recent discussions with HPC system vendors and buyers. There is a large variation in the impacts of the virus for different segments of the HPC market. Hyperion Research is developing a detailed analysis of these impacts in order to create updated forecasts for HPC servers, AI, ML, DL, and public cloud spending for running HPC workloads.

Hyperion Research CEO Earl Joseph said the company reiterates its mid-March guidance that it is too soon to accurately quantify the specific covid-19 impact on the worldwide HPC market but does see tough times ahead for certain market sectors, including manufacturing, multi-media, and geosciences. Joseph noted that there could be an upturn in HPC buying to directly support covid-19 and related pandemic research in sectors including bioscience, government, and academia, but funding for those acquisitions could come at the expense of some lower-priority workloads and therefore might not increase planned HPC spending. In addition, the use of public clouds for HPC workloads will likely grow even faster than the 24.5% CAGR Hyperion Research has expected during the forecast period.

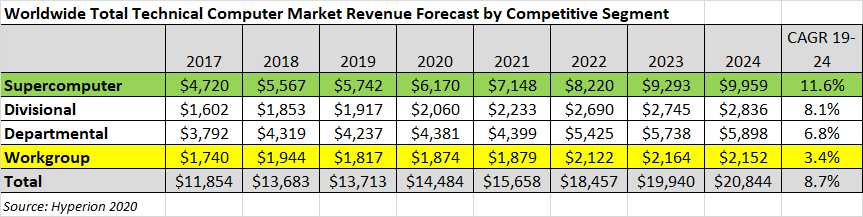

Hyperion Research’s forecasted impacts by competitive segments (which are based on the price of the system):

- Supercomputers. In the short-term, worldwide revenues for the supercomputer segment (HPC server systems priced $500,000 and above) should closely match the Hyperion Research pre-covid-19 virus forecasts. The supercomputer segment is characterized by large contracts often awarded years ahead of planned system deliveries, keeping supercomputer system vendors’ order pipelines stable even during unexpected economic downturns. However, a protracted economic downturn and a tightening of government funding in the next few years could cause these order pipelines to shrink, leading to a downturn in high-end procurements in 2023 and beyond. In addition, 2020 may see some impacts due to delays in both building and installing systems. Hyperion Research believes that this segment has some upside potential during the forecast period because of emerging global demand for supercomputer-based covid-19 research. However, post-covid-19, most governments will be facing large budget deficits and competing demands for funding, and any sales to support biosciences research could cannibalize other HPC procurements of research programs deemed less critical.

- Workgroup. The Workgroup segment (HPC server systems sold for $100,000 or less) will likely be affected most by the pandemic, as these orders are seldom signed far in advance of deliveries and can more readily be postponed or canceled during economic downturns. There was a significant downturn in this segment during the global 2007-2008 economic recession, and the segment took ten years to recover to its 2007 levels. Even before the pandemic, Hyperion Research predicted modest CAGR growth of only 3.4% during the forecast period. This growth rate may be ambitious because the pandemic is likely to accelerate workgroup buyers’ growing tendency to migrate HPC workloads to third-party clouds and avoid capital expense associated with acquiring on-premises HPC systems.

- Divisional and Departmental. The midrange Divisional and Departmental segments will likely fare better than their Workgroup counterpart but will still see some challenges. In the face of a long-term economic slowdown in consumer spending and a significant debt load incurred during the covid-19 crisis, some commercial firms that typically buy midrange HPCs will be concentrating on short-term financial demands and be hard-pressed to maintain their previous procurement patterns for HPCs, especially those targeted to support long-term product development. Hyperion Research expects this to have a moderate impact of these segments, which also derive revenue from government and academic buyers.

- Hyperion Research forecasts for these competitive segments for the period 2020-2024 are outlined in Table 1.

The figures in Table 1 are in millions of U.S. dollars and represent Hyperion Research revenue forecasts prior to the covid-19 virus outbreak. The color-coding reflects the expected covid-19 impacts, with green representing a likely positive impact; white indicating limited to moderate impact; yellow representing strong negative impact; and red indicating the most severe negative impact.

Table 1 Pre-Virus HPC Server Forecasts, with Colors Indicating Predicted Covid-19 Impact

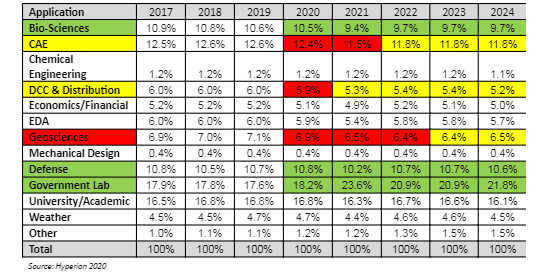

Hyperion Research’s forecast by vertical segments shows that some segments will fare better than others, but ultimately every sector will be facing some difficult financial choices about where to best commit limited funds among a range of competing requirements. Segments that depend heavily on HPC to support operational capabilities or to support on-going business processes will likely remain committed to some form of their pre-covid-19 procurement plans while those that use HPC primarily in industries that are facing major economic impacts will likely seek to reduce, delay or even cancel procurements until economic conditions improve. Noteworthy sectors include:

- Bio-Life Sciences. Already targeted by Hyperion Research for robust 9.7% CAGR before the pandemic began (Table 2), this segment will likely get an added boost, especially in 2021 and 2022, from escalating demand for covid-19 research on HPC systems. Note that the boost is relative to the other verticals as shown in Table 2.

- Government Labs and Defense. These important HPC segments should achieve the growth projections shown in Table 2, though perhaps with some supply chain delays in 2020 and 2021. Acceptances may be delayed, but most orders are unlikely to be postponed or canceled. Advance orders for pre-exascale and exascale supercomputers will be important growth drivers during the forecast period.

- Manufacturing. The severe global economic impact of the pandemic is likely to cause a substantial reduction in the purchasing of products designed with HPC help, especially aircraft and automobiles. Reduced revenues will put pressure on these manufacturers to limit spending on new HPC systems for at least two years, and likely longer. In addition, this sector may switch more workloads to public clouds going forward in order to more closely control costs.

- Media (Digital Content Creation). This sector is already being hit hard by the pandemic-related closing of movie productions and movie theaters worldwide. It may take a year or two before audiences are comfortable sitting close together in theaters again. The online gaming portion of this segment may get a boost because it is usually a solo activity and can relieve the tedium of social isolation. In addition, this sector may transition more workloads to public clouds going forward.

- Oil and Gas (Energy). This sector will likely be hit hardest of all, due to a “perfect storm” of low prices, massively reduced demand due to travel restrictions, and related economic impacts. Recovery in this segment should be under way by 2023.

Table 2 Virus Impacts to HPC Vertical Segments (Note that this table is showing the relative sizes of each vertical.)