Instead of its usual mid-year HPC market update presented at the ISC conference in Frankfurt, industry analyst firm Hyperion Research has virtually released its latest findings – including estimates of COVID-19 ‘s impact on the industry, on growth of HPC in public clouds and a significant shift in the competitive standing among the leading HPC server vendors.

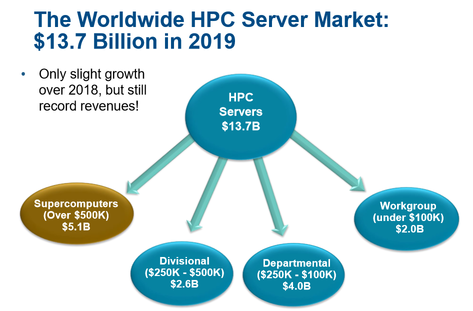

Taking 2019 in total, Hyperion sized the HPC server market at $13.7 billion, record revenues for the industry though up only slightly over 2018. By categories, the supercomputer sector (systems priced more than $500,000) came to $5.1 billion, followed by departmental systems ($100,000-$250,000) at $4 billion; divisional systems ($250,000-$500,000) at $2.6 billion and workgroup systems (less than $100,000) at $2 billion.

COVID-19’s impact on the industry will come in at a net first quarter decline of 15-18 percent, Hyperion predicted, due to delayed product shipments caused by worker illnesses and related precautions that “have reduced output and temporarily shut down some factories at HPC component suppliers,” resulting in delayed revenues.

Hyperion CEO Earl Joseph told us the impact of COVID-19 will likely be temporary, though it’s too early to predict the severity or length of that impact.

“We think (the industry) will get back on its feet,” he said, “but we do think it’s going to be a rocky year this year, and we’re not certain about next year.”

He noted that in the last two economic downturns (2001 and 2008-10) HPC was hit “really hard, like a 25 percent decline in one year,” Joseph said. “And then, within two years, the industry totally recovering and went into hyper growth mode. So, generally, the market tends to weather things pretty well, although you do have a window where there’s a problem.”

But COVID-19 may have positive effect on the industry – Hyperion said public cloud computing for HPC workloads may grow faster than previously predicted.

Joseph also noted that the pandemic is hitting the lower end of the market (HPC servers priced less than $100K), leaving it “likely to have a number of difficult years.”

He attributed this to three factors: first, the lower end of the market was already increasingly moving HPC workloads to public clouds before the pandemic hit; second, purchasers of low-end HPC servers tend to be small/medium sized businesses that are harder hit during recessions – and therefore more likely to retain their existing hardware longer. “So let’s say if they used to upgrade every three to four years, if they add one year to that upgrade cycle that effectively cuts the market down by 25 percent,” said Joseph.

COVID-19’s impact on the industry will come in at a net first quarter decline of 15-18 percent, Hyperion predicted, due to delayed product shipments caused by worker illnesses and related precautions that “have reduced output and temporarily shut down some factories at HPC component suppliers,” resulting in delayed revenues.

Third: large HPC centers, such as those at major oil and gas companies, typically have had two or three supercomputers along with three or four dozen workgroup machines. “I think what’s going on is because the big machines are getting so much larger, they’re trying to push more workloads to the big machines and then cut their spending on satellite systems,” Joseph said.

HPC Vendor Server Market Shares — IBM Downturn

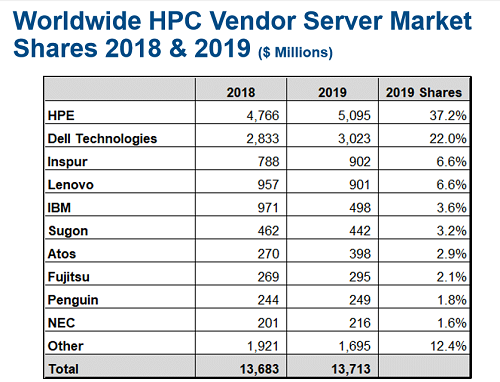

In the competition for supremacy among the HPC server vendors, HPE (which acquired Cray last year) extended its lead over second place Dell Technologies in 2019 – and the two of them significantly extended their dual lead over the rest of the pack, according to Hyperion.

HPE, which Joseph said “had a good year” in its own right, totaled more than $5.1 billion in HPC server revenue for the year for a 37 market share, while Dell totaled $3 billion for a 22 percent share. They were followed by Inspur and Lenovo, each at 6.6 percent share.

HPE, which Joseph said “had a good year” in its own right, totaled more than $5.1 billion in HPC server revenue for the year for a 37 market share, while Dell totaled $3 billion for a 22 percent share. They were followed by Inspur and Lenovo, each at 6.6 percent share.

Behind them came IBM, which took a significant drop from nearly $1 billion in 2018 HPC server revenues to $498 million last year, or 3.6 percent market share, much of this related to the company’s failure — despite currently having deployed the world’s two most powerful supercomputers, Summit and Sierra, at U.S. Department Energy national labs – to mount winning bids last year to build exascale-class systems for DoE (all four contracts were won by HPE-Cray).

“If I look at it over a two year window,” Joseph said, “…there’s only two major vendors now. HPE and Dell are tending to grow a little bit faster.

“The other significant change here is IBM shrunk almost in half…, and I think it’s a mix of the product cycle they’re in and also not having a major (government supercomputer) win coming in. They had large DoE wins, which helped them to be closer to a billion dollars (in 2018) and they didn’t have anything from those (exascale contracts) in 2019. And the next four of them Cray has already won. So I think, you know, IBM is struggling at the moment.”

Earl Joseph

Looking ahead, Hyperion projects solid market growth, predicting an 8.7 percent CAGR reaching $20.8 billion in 2024. The high-end of the industry, the supercomputing category, is predicted to grow the fastest with a CAGR of 11.6 percent, driven largely by government procurement of exascale machines. The low-end workgroup category is expected to have the lowest CAGR, 3.4 percent, with divisional and departmental systems coming in at 8.1 percent and 6.8 percent CAGRs, respectively.

By vertical sectors, government labs and university/academic will be the biggest drivers of industry growth, comprising 21.8 percent and 16.1 percent, respectively, of the total market in 2024, followed by computer aided engineering (11.8 percent), defense (10.6 percent) and bio-sciences (9.7 percent).

Joseph noted that Hyperion’s forecast numbers do not yet include COVID-19’s impact.

Cloud HPC Growth

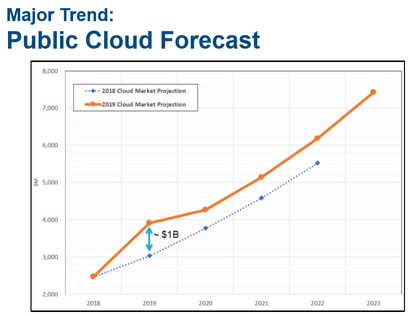

Another important trend highlighted by Hyperion: greater growth than expected in public cloud HPC. Hyperion has upped its forecast – in 2018 the firm predicted revenues to reach $5.5 billion in 2022, now the firm predicts $6.2 billion in two years; in 2023, Hyperion expects public cloud HPC revenue to reach $7.5 billion.

Joseph said there’s been a market shift beyond HPC experimentation in public clouds along with maturation in CSP’s HPC offerings.

Joseph said there’s been a market shift beyond HPC experimentation in public clouds along with maturation in CSP’s HPC offerings.

Four years ago, said Joseph, “there were a lot of people using public clouds, but they were primarily experiments, they were testing it, seeing where it worked.” And users found public cloud HPC to be lacking. “For most hard HPC jobs, the performance of the cloud was terrible,” he said, “they spent so much time optimizing their on-prem environment…, it took like 10 times the number of CPU hours to run the same job.”

But over the last two years in particular, the clouds have hardware and software, including Linux environments, that are more “HPC friendly,” Joseph said, but the biggest factor has been adding expertise to senior management. Even more important, Joseph said, has been public cloud HPC hiring and acquisitions: citing HPE (Cray) SVP and HPC liminary Steve Scott recent move to Microsoft Azure, along with Azure’s 2017 acquisition of Cycle Computing, Joseph said, “I actually think the biggest thing is they’ve hired a lot of HPC people that are vertical experts… They’ve all been building up their HPC-centric departments.”

Cautioning that Hyperion does not yet have survey data in this area, Joseph said, “I think a big reason for that is because they see this massive AI market and they realize HPC-like technologies are needed to drive AI jobs. And so they’re seeing two sides, there’s business in getting HPC folks in the cloud, but by making their clouds in a more HPC-like fashion, they can do a lot better with AI.”

Another factor for cloud HPC growth: end user adaptation.

“HPC users have been rewriting their codes and understanding better what fits in the cloud and what doesn’t,” Joseph said. “For the (workloads) that are really difficult, they keep those on prem, but the ones that are more embarrassingly parallel or just fit better in the cloud” thus move to public cloud platforms.

The Race to Exascale

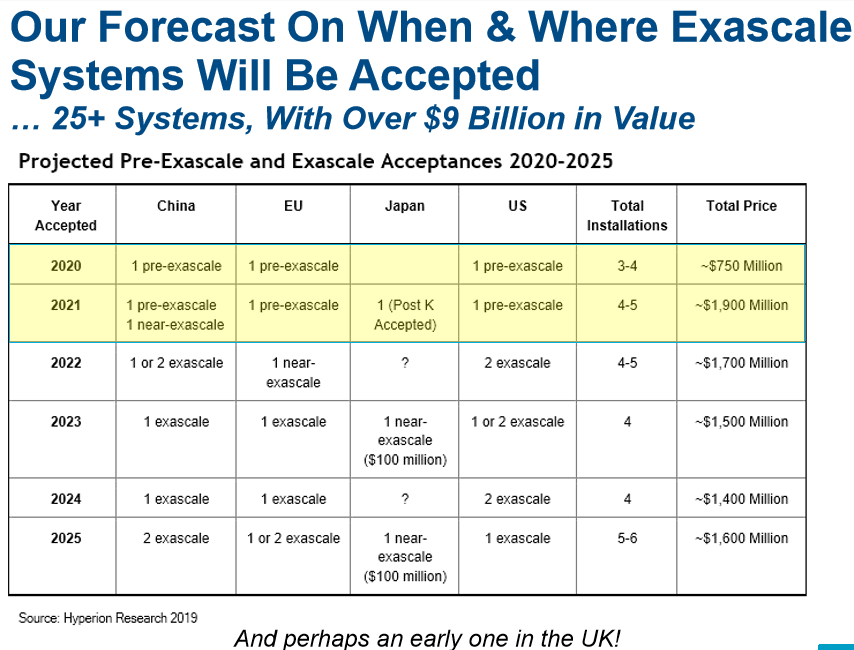

Hyperion reissued its table of expected exascale system deliveries, which Joseph said contained no significant surprises – which he said is somewhat surprising.

“To us, the surprise right now is we think that most of them are still going to happen, there hasn’t been a major COVID-19 virus impact,” said Joseph. “There have been some delays that we think are from supply chain issues and we’re hearing some rumors about some other additional delays, but those are just delays – getting the whole thing installed versus canceling the contract or cutting the money out of it.”

“To us, the surprise right now is we think that most of them are still going to happen, there hasn’t been a major COVID-19 virus impact,” said Joseph. “There have been some delays that we think are from supply chain issues and we’re hearing some rumors about some other additional delays, but those are just delays – getting the whole thing installed versus canceling the contract or cutting the money out of it.”

At the same time, he expects vendors whose exascale deployments miss delivery dates will readily use the pandemic as an excuse.

“Giant systems always have delays in the project program, right? …we’re expecting that over the next six months, if there are delays, they’re probably going to blame the virus. I mean, it’s just such a nice thing to be able to say.”