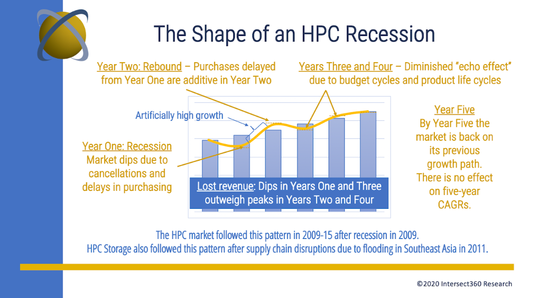

Industry analyst firm Intersect360 has announced its forecast for the HPC industry for this year and next, predicting a 3.7 percent decline for 2020 with a market rebound in 2021.

Pegging the size of the industry at $39 billion in 2019, a jump of 8.2 percent from 2018, the firm predicted “significant disruption” to the HPC market in the short term as a result of the COVID-19 pandemic, primarily seen as a 3.7 percent market shortfall in 2020, followed by a corresponding spike upward in 2021.

In spite of the 2020 dip, its first in 10 years, the HPC market will grow at a 7.1 percent compound annual growth rate through 2024, to reach $55.0 billion at the end of the forecast period.

“In forecasting the effects of the pandemic, we’re not operating in a vacuum,” said Intersect360 Research CEO Addison Snell. “We’ve seen recessions before, and we’ve seen supply chain disruptions, such as what happened with the horrible floods in Southeast Asia in 2011, and the resulting effect on the storage market. The market is about to take a very strange shape. 2020 will be down significantly, but most of this shortfall is from purchases that are delayed, not canceled. So long as the economy comes back in 2021, we’ll see a big spike as those delayed HPC purchases get realized.”

The HPC market is covered in a series of four reports released by Intersect360 Research this week, which analyze not only the effects of COVID-19 on the market in 2020, but also emerging trends and the state of the industry at the end of 2019:

The HPC market is covered in a series of four reports released by Intersect360 Research this week, which analyze not only the effects of COVID-19 on the market in 2020, but also emerging trends and the state of the industry at the end of 2019:

- Worldwide HPC 2019 Total Market Model and 2020–2024 Forecast: Products and Services

- Worldwide HPC 2019 Total Market Model and 2020–2024 Forecast: Vertical Markets

- Worldwide HPC 2019 Total Market Model: Server Revenue Shares

- Worldwide HPC 2019 Total Market Model: Storage Revenue Shares

“We saw the shape of the market really start to change in 2019,” says Snell. “All segments were up, but the real growth was in cloud computing, plus other arrangements you could describe as cloud-like, such as managed services contracts, outsourced facilities, and other forms of HPC as a service.”

According to the reports, after six years of the industrial sector driving HPC market, government spending is back at the forefront of HPC growth. Snell predicts, “This will be the most stable sector over the next five years. Many austerity measures have been relaxed, and government spending has come back up. There’s a big push to AI, of course, as well as mustering resources to combat COVID-19. Beyond that, the race to Exascale continues to add energy into supercomputing.”

Addison Snell, CEO, Intersect360 Research

According to the reports, after six years of the industrial sector driving HPC market, government spending is back at the forefront of HPC growth. Snell predicts, “This will be the most stable sector over the next five years. Many austerity measures have been relaxed, and government spending has come back up. There’s a big push to AI, of course, as well as mustering resources to combat COVID-19. Beyond that, the race to Exascale continues to add energy into supercomputing.”

Snell said cloud HPC offers significant opportunity. “Cloud computing is the segment that will do the opposite of everything else. When on-premises server and storage purchases are delayed, cloud computing can help bridge the gap. There will be a big spike in cloud computing for HPC this year, as other forms of acquisitions are constrained.”

Snell plans to present Intersect360 Research’s HPC market forecast at a free webinar Thursday, August 6 at noon Eastern Time. Registration is at intersect360update.eventbrite.com.