Though embryonic, the quantum computing industry is coming into focus, taking on the earmarks of a viable entity on the computing landscape – earmarks that have progressed beyond the possibilities, promises and potential that have mostly characterized the technology to date.

Though embryonic, the quantum computing industry is coming into focus, taking on the earmarks of a viable entity on the computing landscape – earmarks that have progressed beyond the possibilities, promises and potential that have mostly characterized the technology to date.

Examples:

- as quantum offers increasing early-stage utility, we can foresee the way in which it will likely be implemented within advanced computing infrastructures;

- we have insight into the quantum purchasing motives of IT planners – and they don’t expect “quantum supremacy”;

- the quantum market can be sized with accompanying CAGR projections;

- while many different quantum hardware approaches are under development, we see the emergence of common quantum software stack supporting varying hardware modalities;

- quantum R&D is led by the U.S. and China, but it’s happening in countries around the world, including some surprising ones;

- when important quantum development breakthroughs will happen, and by which countries and companies, is unclear.

These are among the key findings presented at last week’s HPC User Forum by Bob Sorensen, Senior Vice President of Research at industry research firm Hyperion Research. Let’s go through Sorensen’s findings in turn.

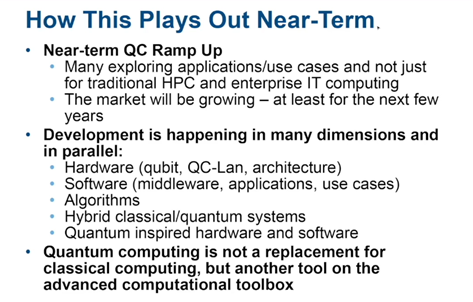

The promise of quantum computing is, of course, immense. The concept of leveraging quantum physics phenomena, such as superposition and entanglement and other quantum arcana, while operating in the quantum space versus the classical, binary, digital space, could potentially solve problems far beyond the capabilities of classical supercomputers – assuming quantum comes to fruition. But quantum’s isn’t expected to replace but to augment.

“If there’s one takeaway … from today’s discussion it’s that quantum computing is not a stand-alone technology,” Sorensen said. “It’s not something where you say ‘here’s classical computing over here on one island, and quantum computing on another island.’ Quantum computing is more about having another tool in the toolkit for advanced computing. Think of it in some sense as a version of a GPU in that quantum computing offers some significant performance advantage for a key but narrow set of applications that ultimately complements the overall advanced computing architecture. But it certainly will not supplant and will not replace (classical HPC).”

Bob Sorensen

Quantum applications are already serving useful purposes, said Sorensen.

“One of the most popular is the optimization opportunities in quantum,” he said, “the ability to take existing algorithms or existing objective functions to optimize a process, turn it over into the quantum realm and figure out better ways to maximize an outcome.” A typical example, he said, is devising the best way to load into the cargo hold of an airliner a large amount of luggage and other materials in the least amount of time – problems like that are driving a lot of interest in quantum computing today, and that list is growing longer each day.”

source: Hyperion Research

These are known as “constrained optimization” challenges and include factory floor layout, materials movement and the “traveling salesperson” problem, maximizing the efficiency and minimizing the cost of a salesperson’s travel schedule.

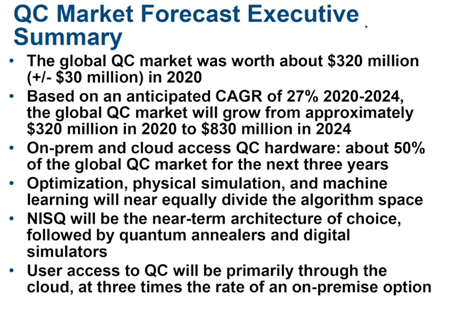

As to quantum market sizing, Hyperion reported last year in a study for the Quantum Economic Development Council that the quantum computing was worth about $320 million in 2020 worldwide. Healthy growth is ahead. Sorensen said a 27 percent CAGR is anticipated over the next three to four years.

“The point of this exercise was to really say quantum computing is a market,” Sorensen said. “We can basically say there’s some growth here because we’ve got committed from end users in terms of budgetary commitments over the next few years, there is some stability to the market, there is a way to size it.”

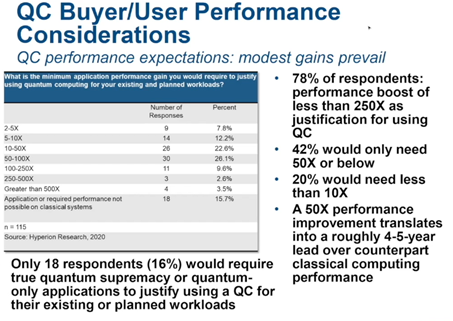

Driving demand is not expectations of quantum supremacy – quantum solving problems no classical computer can handle in a feasible amount of time. In fact, according to a Hyperion market survey, buyers’ expectations of quantum seem relatively modest. Sorensen said 42 percent of users surveyed said a 50x speed-up in application performance would induce them to seriously consider purchasing a quantum system, and 20 percent said they would only need a 10x speed-up.

source: Hyperion Research

“I find this to be a very satisfying result because it means the while some of us perhaps over-emphasize quantum supremacy and the incredible speed-ups that quantum can bring in the near or perhaps the distant future, the user base is saying, ‘All I need is a four to five year boost over my competitors based on what I would see in the classical world.’ A 50x performance improvement is really what you’re going to get in the in the classical HPC world if you wait five years. That’s what the users are interested in right now. And I think that’s important point to make to the suppliers of the quantum sector, that the users are looking for competitive advantage and economic payoff in quantum, they’re not looking for the very aggressive, far-reaching performance potentials of quantum, they just want to be able to work faster and smarter on their near term jobs.”

While quantum R&D efforts are taking on enormous technical challenges, Sorensen said there is an emerging structure supporting many of the quantum hardware approaches under development.

source: Hyperion Research

“There are a myriad software companies out there trying to find their place in the quantum computing ecosystem, whether it be for quantum compilers, quantum applications or even quantum surfaces, if you will, targeted specific verticals…,” he said. “The sector is somewhat coalescing into an organized hardware-software stack, software companies can now offer products that are usable on a number of different modalities… There’s lots of opportunities out there, and no one knows who’s going to win.”

The good news, of course, is that organizations can write software that can run on different vendors’ hardware, Sorensen said, avoiding the necessity picking a single hardware modality or vendor.

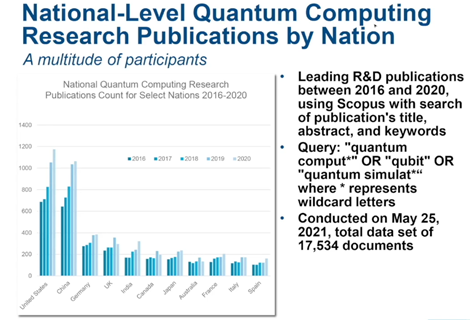

Not surprisingly, the US and China lead all other countries in quantum R&D, as measured by research publications. On the other hand, the pursuit of quantum is an international phenomenon comprised in part, by countries not thought of as tech powerhouses, such as Canada, Italy and Spain.

source: Hyperion Research

“Quantum computing is not a technology or an activity that is centered in one particular geographic location or owned by one particular IT organization or series of organizations,” Sorensen said. “This is not an extension of legacy IT, this is not something that the US owns by default, based on 40 years of IT leadership. This is not something that companies involved in classical IT or countries that have been involved in classical IT has any kind of leg up. It’s a greenfield technology, and it makes for some very interesting implications going forward.”

Sorensen also pointed out that the volume of research is on the rise.

“The general trend is towards more research,” he said. “It’s fascinating … that not only are many countries doing this but almost all of them are on a serious upswing… The decisions haven’t been made on who the winners and losers are, and there’s an awful lot of activity, a lot of it is coming from countries that, I like to say, are punching above its weight… that … are playing quite aggressively to get involved early on in the quantum computing sector.”