credit: IBM

Quantum is in the news this week, with IBM today announcing new research on its “entanglement forging” simulation method and Multiverse Computing launching a quantum-based method for financial institutions to calculate stock valuations.

At IBM, “entanglement forging” creates a “remarkably accurate” simulation of a water molecule using half as many qubits on IBM’s 27-qubit Falcon quantum processor, according to the company. IBM said the new simulation method could represent a step toward achieving quantum advantage, when a quantum computer can perform a task much faster than a classical computer. The irony in this case is that entanglement forging utilizes both quantum and classical techniques.

“We’ve come a long way in terms of our ability to model complex physical systems on quantum hardware,” wrote Robert Davis, a technical writer for IBM Quantum in a blog announcing the news, “and it seems that each year brings both powerful new tools and remarkable achievements in the field of quantum simulation. But despite all that progress, today’s quantum computers are still too small and noisy to exhibit full quantum advantage.

Aiming to boost quantum simulation technology, a team of IBM researchers decided that rather than enhancing the quantum hardware, they pursued development of new techniques for combining quantum and classical computing resources.

In their paper, Doubling the Size of Quantum Simulators by Entanglement Forging, published in PRX Quantum, the IBM Quantum research team found that under most circumstances, if researchers want to simulate 10 spin-orbitals of a water molecule they’d need to use a quantum computer with at least 10 qubits. That’s because most quantum simulation techniques require one qubit for each relevant “feature” of the systems they simulate. But with entanglement forging, the researchers split the problem in half, separating the 10 spin-orbitals into two groups of five and processing each grouping using just five qubits.

![]() The upshot, according to IBM: “Given its scalability and broad application across a variety of problem structures, entanglement forging could markedly expand the computational power of quantum systems, especially when combined with new programming models like IBM Quantum’s quantum serverless — a new programming model that takes advantage of quantum and classical resources.”

The upshot, according to IBM: “Given its scalability and broad application across a variety of problem structures, entanglement forging could markedly expand the computational power of quantum systems, especially when combined with new programming models like IBM Quantum’s quantum serverless — a new programming model that takes advantage of quantum and classical resources.”

“We demonstrated a method that in many cases will allow you to run larger problems on your quantum processor than you otherwise could,” said Andrew Eddins, IBM Quantum researcher and lead author on the recent paper. “Entanglement forging provides an efficient method of bringing classical computational resources to bear on quantum problems in a way that, in one respect, doubles your capability. It effectively increases your qubit number by a factor of two, which is really remarkable.”

Over at Spain-based Multiverse Computing, the company today announced its new Fair Price valuation calculation capability as part of its Singularity financial quantum computing offering, designed to be front-ends and plugins for common PC-based applications enabling access quantum computing without requiring quantum expertise or knowledge.

Over at Spain-based Multiverse Computing, the company today announced its new Fair Price valuation calculation capability as part of its Singularity financial quantum computing offering, designed to be front-ends and plugins for common PC-based applications enabling access quantum computing without requiring quantum expertise or knowledge.

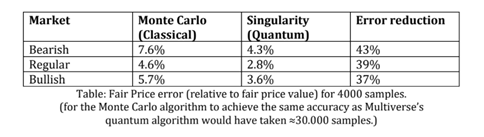

Financial institutions typically use Monte Carlo simulations on classical supercomputers to calculate theoretical stock values – calculations that take up to 24 hours. Using trapped ion quantum computers from IonQ and PC-based software tools, Multiverse said the Singularity Fair Price solution can reduce error rates by 43 percent without increasing the number of runs or runtime.

“To achieve the same accuracy on a classical computer would take over seven times the number of runs, enabling financial institutions to achieve a more accurate valuation more quickly,” the company said.

Multiverse cited a chart from a paper, titled Quantum Portfolio Value Forecasting, produced by the company’s scientific team showing the reduction in Fair Price errors in different market categories:

“The Fair Price feature on our Singularity platform is designed to give financial institutions an edge in portfolio optimization using quantum computers from our preferred partner IonQ,” said Enrique Lizaso, CEO of Multiverse. “This new feature is a perfect complement to our Singularity product, making it easy for the financial community to leverage quantum computing today for demonstrated value even at this early stage of the industry.”

“The Fair Price feature on our Singularity platform is designed to give financial institutions an edge in portfolio optimization using quantum computers from our preferred partner IonQ,” said Enrique Lizaso, CEO of Multiverse. “This new feature is a perfect complement to our Singularity product, making it easy for the financial community to leverage quantum computing today for demonstrated value even at this early stage of the industry.”