Earl Joseph, CEO, Hyperion Research, at market update breakfast in Hamb

The HPC industry managed to achieve modest overall growth in 2022, but growth of any kind was in doubt right up to the end of the year, according to HPC-AI industry analyst firm Hyperion Research, which hosted its bi-annual HPC market update at a breakfast event this week during the ISC 2023 conference in Hamburg.

According to the firm’s findings, HPC grew by 4 percent last year, but “we were very concerned throughout the year,” said Hyperion CEO Earl Joseph, adding that “with all the supply chain issues and the economic impacts, it did not grow at the same rate we were hoping for.”

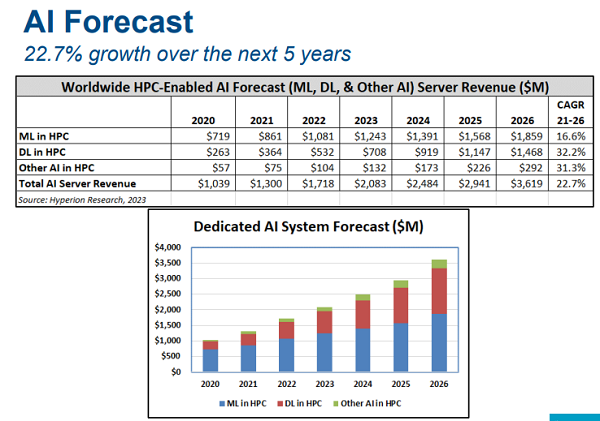

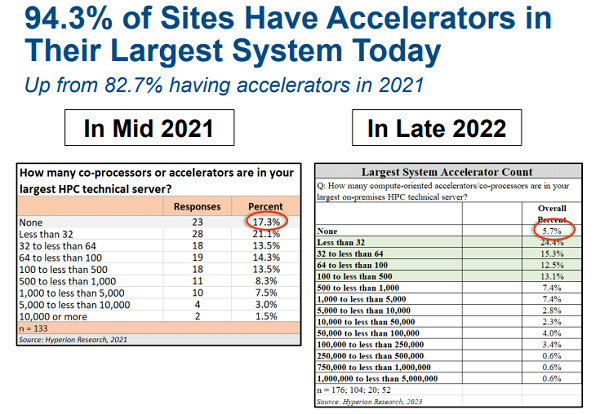

Growth in the larger HPC-AI sector is expected to be stronger in 2023, in part this is likely to reflect explosive growth in sales of AI accelerators and GPUs in servers used for generative AI workloads. Hyperion reported that 94.3 percent of sites surveyed have accelerators in their largest system today, up from 82.7 percent in 2021. Hyperion’s findings reflect the latest quarterly earnings from GPU market leader NVIDIA. Released this week, they were well above estimates and drove up NVIDIA shares higher by 25 percent.

Longer term growth in generative AI is expected to be a key HPC industry driver over the next four years, resulting in a sector CAGR for the 2021-2026 period of 17.9 percent, according to Hyperion.

“AI is becoming more pervasive,” Joseph said. “Chat GPT really put a spotlight on what AI can do, it’s a big success story and people are using it. We’re talking to a large number of users, buyers and consumers of products with all different ideas of how AI could be used, and Chat GPT is good sign of it.”

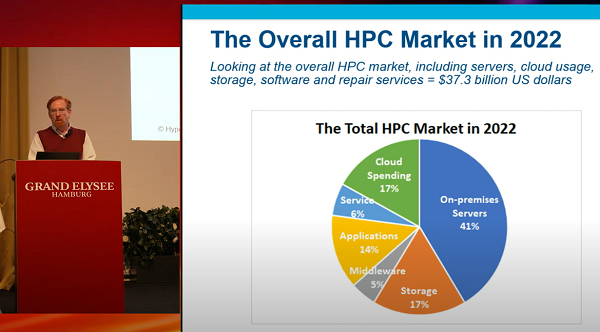

As for 2022, Joseph said the HPC industry’s 4 percent growth applies to the entire market, including on-premises servers, storage, middleware and application services, along with spending to run HPC workloads from the cloud. He said there had been hope that the industry would grow by 6 or 7 percent, “but some things (i.e., realized revenue) slipped from 2022 to 2023.”

As for 2022, Joseph said the HPC industry’s 4 percent growth applies to the entire market, including on-premises servers, storage, middleware and application services, along with spending to run HPC workloads from the cloud. He said there had been hope that the industry would grow by 6 or 7 percent, “but some things (i.e., realized revenue) slipped from 2022 to 2023.”

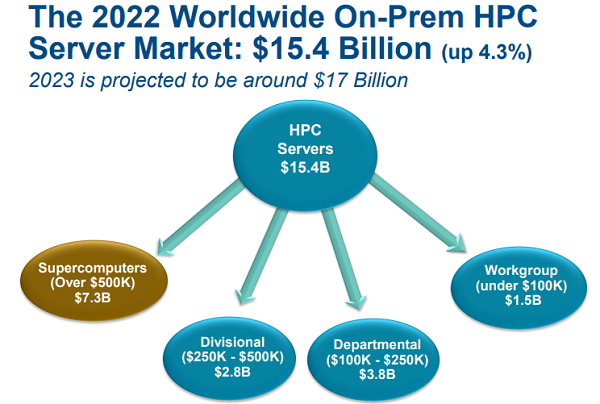

Overall industry revenues were boosted by the $7.3 billion supercomputer segment (systems priced at more than $500,000), with revenue from leadership-class exascale and pre-exascale systems spurring growth.

In the ongoing horse race for HPC on-prem server supremacy, HPE held its lead over its perennial second-place rival Dell, according to Hyperion. HPE tallied $5.1 billion in server revenue in 2022 while Dell came in at $3.6 billion. They were followed by Lenovo ($1.2 billion), Inspur ($1.1 billion) and Sugon at $600 million. Other leading HPC server vendors, in order of sales: IBM, Atos (Eviden), Fujitsu, NEC and Penguin.

Divided by on-prem server market segments, the government lab sector was the largest ($3.3 billion), followed by university/academic ($2.7 billion), CAE ($1.8 billion), defense ($1.6 billion) and bio-sciences ($1.1 billion). If government labs and defense were combined into a single government category, it would amount to nearly $5 billion.

Divided by on-prem server market segments, the government lab sector was the largest ($3.3 billion), followed by university/academic ($2.7 billion), CAE ($1.8 billion), defense ($1.6 billion) and bio-sciences ($1.1 billion). If government labs and defense were combined into a single government category, it would amount to nearly $5 billion.

Looking ahead, Hyperion predicts “decent growth” in 2023 helped by acceptance of several exascale-class leadership systems along with growth in AI and cloud HPC spending. The firm said the market will reach approximately $17 billion in on-prem server revenues and $33 billion in total on-premises HPC spending this year.

Hyperion expects HPC cloud spending to grow from $6.3 billion in 2022 to $7.4 billion this year. Looking out further, cloud HPC is predicted to reach $11.6 billion in sales by 2026. During the 2020-2026 period, Hyperion said cloud HPC will enjoy a 17.9 percent CAGR.

Hyperion expects HPC cloud spending to grow from $6.3 billion in 2022 to $7.4 billion this year. Looking out further, cloud HPC is predicted to reach $11.6 billion in sales by 2026. During the 2020-2026 period, Hyperion said cloud HPC will enjoy a 17.9 percent CAGR.

Joseph said Hyperion anticipates a “tipping point” of rapid cloud HPC growth in part driven by AI.

“We think, with Chat GPT, generative AI, large language models and everything that’s happening in AI has shown a spotlight on how AI can be used and will cause and kind of trigger, that next tripping point,” he said. “…we’re looking at around 18 percent growth over a five-year window, which is just phenomenal growth here in the market. We’re expecting to see the spending for HPC in the cloud to be on the order of $12 billion by 2026.”

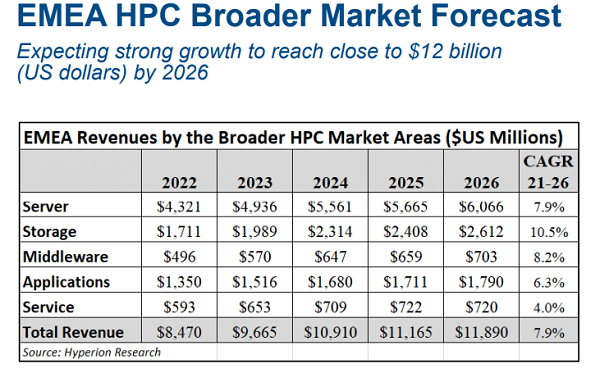

Europe continued in 2022 to emerge as a rising HPC region (two of the top four systems on the TOP500 list of the world’s most powerful supercomputers are on the continent). Hyperion reported that for the overall EMEA (Europe, Middle East and Africa), the supercomputer server sector will reach $2.2 billion in 2023, growing to $2.9 billion in 2026 for a CAGR from 2022-2026 of 9.3 percent.