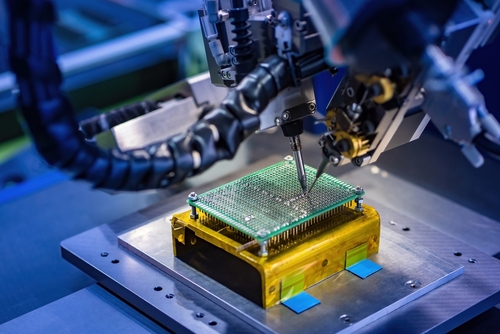

credit: Shutterstock

To the combination of economic and geopolitical forces generating high global inflation and rising recession expectations can be included the continuing shortage of microprocessors that, according to a story in the Wall Street Journal, could directly impact on advanced chips, including those used in HPC and AI. While the chip shortage is not new, its spread to advanced chips is a more recent development, according to the Journal article.

“Chips with the tiniest transistors and highest performance had largely escaped the drought that has hit the auto industry and other electronics,” the Journal reported. “Now, problems ranging from production hitches to a shortage of manufacturing equipment have raised concerns over the ability of the world’s two highest-end chip manufacturers (Taiwan Semiconductor Manufacturing Company, Samsung) to meet delivery promises to customers.”

The problem could show up in supply chains as early as next year, “with one analyst warning of shortfalls as high as 20 percent for the most advanced chips by 2024 and beyond. Without improved chips, technologies such as high-performance computing, artificial intelligence and more evolved forms of autonomous driving might see a slowdown in deployment, industry analysts say,” the Journal reported.

As aspect of the problem, the Journal noted, is that only two companies, TSMC and Samsung, “are capable of building the industry’s most cutting-edge chips.” A third company, ASML Holding NV of the Netherlands, is a developer of lithography technology used in its machinery instrumental to manufacturing advanced chips. ASML told the Journal that supply of its systems can’t keep up with demand from companies like TSMC and Samsung, and that the company is working to increase production.

“Chip-manufacturing equipment is increasingly arriving later than expected, and lead times on new orders have stretched to in some cases two or three years, largely due to a dearth of less-advanced chips,” the Journal reported.

Overall, the Journal reporter that there is “a mismatch” in the planned spending of advanced chip companies in equipment to expand production and the expected revenues of manufacturing-equipment companies. “Chip equipment, which comprises most of the cost of setting up new chip factories, is expected to generate around $107 billion of sales globally this year, according to industry group SEMI. But planned capital expenditures by chip makers is projected to be more than that, at $180 billion, according to chip consulting firm International Business Strategies Inc.”

Technical challenges also have posed problems. The Journal reported that that yields of chips using Samsung’s 4 nanometer process were less than expected, preventing the company from supplying its customers with all the chips ordered this year. This prompted Nvidia, the Journal reported, to turn to TSMC for orders of next-generation products.

Samsung is now “back on the expected yield improvement curve,” Kang Moon-soo, EVP of Samsung’s foundry business, told analysts in May. “Samsung has said that it is on schedule to start mass production of the world’s first 3-nm chips using a novel transistor architecture by this month,” the Journal reported. Mr. Kang also said worries about Samsung’s foundry business “are excessive and unfounded, Mr. Kang said during the call.”

Intel Corp. meanwhile, produces most of its own chips – though it also contracts with TSMC and Samsung for some products. CEO Pat Gelsinger has announced major plans to expand its fab facilities, including new plants in Ohio and Europe, to produce chips for customers, but this is a several-years-long plan at its beginning phase.