One thing – another thing – regular SC conference attendees have to do without this pandemic year is industry analyst firm Hyperion Research’s annual HPC market update breakfast, always held in a large hotel function room before a well-fed, SRO crowd. Instead, Hyperion delivered its update virtually, and much of the discussion, not surprisingly, revolved around COVID-19’s impact on HPC industry revenue and end-user strategies.

One thing – another thing – regular SC conference attendees have to do without this pandemic year is industry analyst firm Hyperion Research’s annual HPC market update breakfast, always held in a large hotel function room before a well-fed, SRO crowd. Instead, Hyperion delivered its update virtually, and much of the discussion, not surprisingly, revolved around COVID-19’s impact on HPC industry revenue and end-user strategies.

Hyperion CEO Earl Joseph said the net impact of COVID on HPC industry revenues for the first half of 2020 was a decline of 11.5 percent. But this will be a temporary problem, Joseph said, because “most vendors expect customers to spend their annual HPC budgets once the COVID-19 threat subsides.”

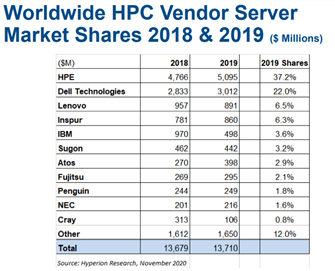

In the market share standings among HPC server vendors, HPE maintained its dominant position with 37.2 percent share in 2019, more than 15 percentage points ahead of Dell Technologies, which was followed by Lenovo at 6.5 percent, Inspur at 6.3 percent and IBM at 3.6 percent.

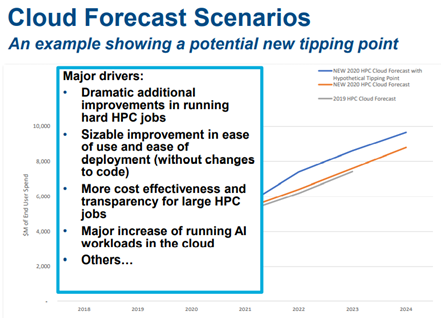

A bright spot for the industry is cloud HPC – Hyperion’s updated forecast projects a 2019-2024 CAGR of 17.6 percent to nearly $9 billion by the end of the period, outpacing projected on-prem HPC server market growth by more than 2.5 times.

A bright spot for the industry is cloud HPC – Hyperion’s updated forecast projects a 2019-2024 CAGR of 17.6 percent to nearly $9 billion by the end of the period, outpacing projected on-prem HPC server market growth by more than 2.5 times.

Hyperion attributed this expected growth to several factors, including “dramatic additional improvements” in running hard HPC jobs, “sizable improvement” in ease of use and ease of deployment without changes to code and more transparency for large HPC jobs.

Other emerging cloud HPC advantages, according to Hyperion, include cost. “As the cloud becomes more friendly to a wider set of HPC workloads, it has become more cost-effective to running certain workloads in cloud platforms.” Other advantages: “Queue times on-prem can be very long; cloud platforms allow users to run workloads on a variety of hardware; some technologies are more efficient for a workload than on-prem deployments; cloud platforms allow for scaling beyond what may be capable on-prem.”

As for on-premises HPC, Hyperion looked into the restraining market factors. In its user site questionnaire surveys, Joseph said, “we often ask ‘What is keeping you back from buying a lot more on prem? What are the (top) barriers?’

As for on-premises HPC, Hyperion looked into the restraining market factors. In its user site questionnaire surveys, Joseph said, “we often ask ‘What is keeping you back from buying a lot more on prem? What are the (top) barriers?’

“No surprise, the financial barriers continue to be the number one issue, but then also power and cooling costs now have grown to almost being half of the site’s at 43 percent. And then density or space limitations is important to 30 percent of the buyers as far as their constraints.”

Another cloud HPC driver is AI. Hyperion research data suggests that the average HPC cloud user anticipates running approximately 20 percent of their HPC-enabled AI workloads in the cloud in the next year. This is due to access to hardware and software not available on-prem, access to data stored in the cloud, including public data sets, IoT and other sensor data and simulation-generated data.

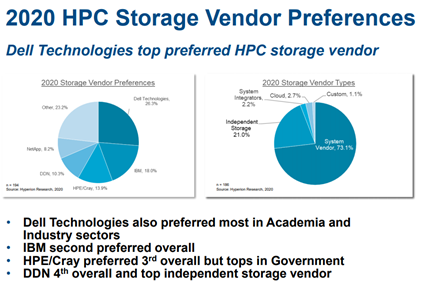

Another bright spot for HPC: storage. Hyperion said storage is historically the highest growth HPC element and that it currently represents 20 percent of HPC spending. Overall HPC storage is projected to reach $38.2 billion by 2024 for a CAGR of 6.7 percent.

In HPC storage vendor standings, Delll Technologies – tapping into its acquisition of EMC some years ago – is in the lead followed by IBM and HPE/Cray, which leads in the government market sector. DDN is fourth and is the leading independent storage vendor.

In HPC storage vendor standings, Delll Technologies – tapping into its acquisition of EMC some years ago – is in the lead followed by IBM and HPE/Cray, which leads in the government market sector. DDN is fourth and is the leading independent storage vendor.

In its exascale update, Hyperion said the first three U.S. systems, budgeted at about $1.8 billion, will begin with the shipment of Frontier to Oak Ridge National Laboratory late next year, with acceptance in 2022. Aurora, which had been scheduled to be the first U.S. exascale system next year, is now expected to be delivered in late 2022 and accepted in 2023, making the Intel system approximately 12 months late, according to Hyperion. The third system, El Capitan, is expected to be delivered in late 2022 with full production targeted for late 2023.

Hyperion said access to its full presentation can be found here.