Intel’s Pat Gelsinger

Pat Gelsinger’s got one foot on a tiger, the other on an aircraft carrier – one side is a rough, volatile ride; the other plows a course set years ago, hard to change direction. Intel’s new CEO has been pulled in different, difficult directions since returning to the company last February. But at a personal level, Gelsinger has assets. On stage at industry conferences and in media interviews he’s a gung-ho, charming guy. A self-identified geek, one can imagine his tech enthusiasm spreading to the lab, to the boardroom, to the cube farm.

That’s the bet Intel made when it re-hired Gelsinger, that his likeable leadership style and tech smarts will right the Intel ship. But short term, the ride is rough. “Anything is acceptable if it’s done with charm,” William F. Buckley said, but in the hyper-competitive chip business, charm has trouble overcoming product delays and price/performance lags.

It’s problems of this type that are chipping at Intel’s previously unassailable position in chips. In HPC, we see a reborn AMD, an aggressive Nvidia and an impressive Taiwan Semiconductor Manufacturing Co. (TSMC) posing a three-pronged menace to which Intel must mount an effective response. And the chip delays must end.

Sadly for the company, they haven’t ended. Intel last month announced that Sapphire Rapids, the Xeon CPU to be used in the company’s delayed Aurora exascale system slated to be stood up at Argonne National Lab next year (it was previously scheduled for this year and was to have been the country’s first exascale system), will be delayed until the first quarter of 2022 rather than by the end of this year, according to the company (Intel said the delay will not impact Aurora’s delivery).

Sapphire Rapids will be teamed in Aurora with Intel’s “Ponte Vecchio” GPU, which the company announced a year ago would be delayed three to six months – the proximate cause of Aurora falling out of first-to-exascale status.

Meanwhile, AMD and Nvidia continue to hit their marks with impressive new products, alliances and acquisitions. While AMD CPUs and GPUs will power Frontier, the U.S.’s first exascale system scheduled for installation at Oak Ridge National Laboratory later this year, GPU juggernaut Nvidia is pushing forward with its acquisition of CPU technology company Arm, with some recent positive signs the deal will receive regulatory approval.

All this is backdrop to a Wall Street Journal article today stating that Intel is expected to post a drop in second-quarter earnings, to be announced later today.

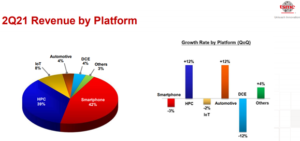

source: TSMC

“Intel after the bell Thursday is expected to post a roughly 10 percent drop in second-quarter sales to $17.8 billion and a profit of $4.2 billion, down from $5.1 billion the year prior, according to analysts surveyed by FactSet,” the Journal reported.

On the high-end chip front, the Journal reported that “Wall Street expects sales of Intel’s data-center chips to fall short of the lofty heights of a year ago, when the pandemic drove rapid uptake in the cloud-computing services that rely on such facilities. Intel also faces stiffer competition from Advanced Micro Devices Inc., which has eaten into its dominant share in data-center chips.”

And even as Intel has farmed out some of its chip production to TSMC, the Taiwan-based chip manufacturing giant in its most recent earnings announcement said the HPC (i.e., high end data center server processors) market segment grew by 12 percent to 39 percent of company revenues, second only to the smartphone market segment. TSMC, of course, is AMD and Nvidias’ chip manufacturer (along with Samsung).

In May, Mercury Research reported that AMD saw its share of server x86 CPUs grow by nearly 2 percent to 8.9 percent of the market, the company’s biggest gain since 2006. In HPC, AMD scored impressive gains in the latest release of the TOP500 list of the world’s most powerful supercomputers; the company now powers 49 of the systems on the list released last month, more than twice as many as were on the list released during the SC 2020 conference last November.

“Although there wasn’t much change to the Top10, that doesn’t mean there weren’t interesting revelations within this year’s list,” Top500 said in its June announcement. “To begin, it would appear that there is a marked increase in the use of AMD processors.”

Impressive as AMD’s growth is, these numbers also point to another Intel advantage besides Gelsinger’s likeability: its 90-plus percent share in high-end server processors. That gives the company a cushion to combat the AMD comeback. But as of now, the AMD tide continues to roll.

“Intel after the bell Thursday is expected to post a roughly 10 percent drop in second-quarter sales to $17.8 billion and a profit of $4.2 billion,”

Intel reported:

Second-quarter GAAP revenue of $19.6 billion

Net income $5.1B